As of early July 2025, Forbes has released its definitive ranking of India’s wealthiest individuals. These towering corporate figures dominate sectors from energy to IT, and their net worths greatly influence both national and global business landscapes. Below is a curated list of the Top 10 richest corporate titans in India with an exploration of their sources of wealth, business influence, and current context.

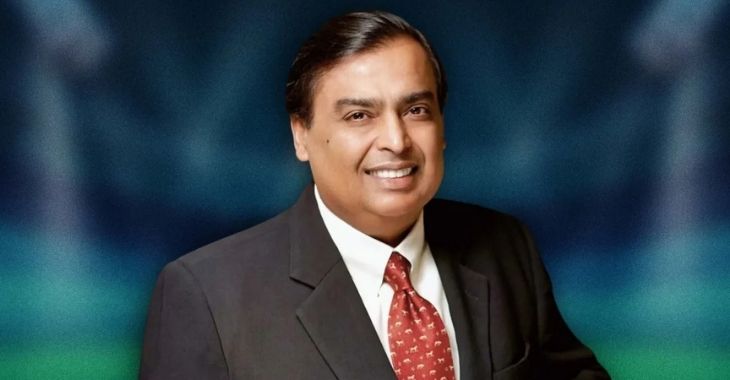

1. Mukesh Ambani – $115.3 billion (Age 68)

Sector: Diversified – Petrochemicals, Retail, Telecommunications (Reliance Industries)§

Once a centibillionaire (net worth over $100 B), Mukesh Ambani has shed over $20 B from his peak in 2024, yet still holds the title of the richest Indian and the only Asian in the global $100 B club. Under his guidance, Reliance Industries has expanded aggressively into retail, telecom (Jio), petrochemicals, and clean energy. In FY25 alone, Ambani and other top promoters earned a staggering ₹40,000 crore in dividends—boosting his personal wealth beyond stock valuations.

2. Gautam Adani – $67.0 billion (Age 63)

Sector: Infrastructure, Energy, Airports, Ports (Adani Group)

Once valued near $84 B, Adani’s net worth declined sharply following market setbacks and allegations linked to Hindenburg Research in 2023. Despite that, he retains the No. 2 spot in India’s list. However, ongoing legal troubles add a complex layer to his profile: in late 2024, Adani faced a U.S. indictment in New York under charges of bribery and fraud tied to a solar project. The allegations involve $265 million in bribes and concealed debts, with arrest warrants issued for Gautam and his nephew Sagar Adani.

3. Shiv Nadar – $38.0 billion (Age 79)

Sector: Information Technology (HCL Technologies)

HCL’s founder and tech visionary, Shiv Nadar occupies the third position in wealth rankings thanks to a legacy built on enterprise software services, outsourcing, and AI development. His firm serves major global clients and continues to grow under his philanthropic and business vision.

4. Savitri Jindal & Family – $37.3 billion (Age 75)

Sector: Steel, Power, Cement (O.P. Jindal Group)

As the only woman on India’s top‑10 list, Savitri Jindal inherited and chairs the sprawling O.P. Jindal Group. Her family continues to diversify into power, infrastructure, and cement. Savitri also serves in Indian politics, maintaining influence across both public and business spheres.

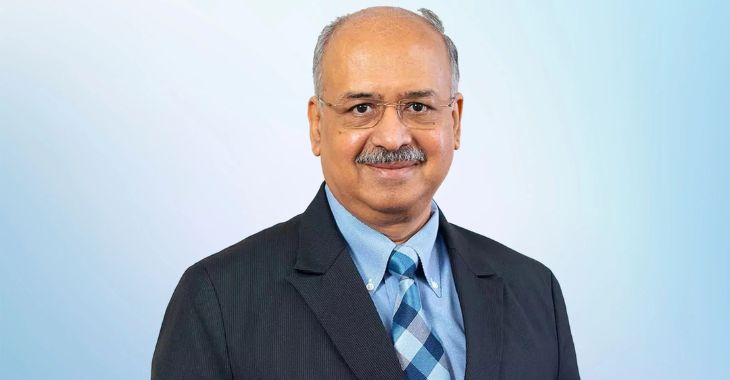

5. Dilip Shanghvi – $26.4 billion (Age 69)

Sector: Pharmaceuticals (Sun Pharmaceutical Industries)

Shanghvi, founder of India’s largest pharma company, has built a global generics empire. Strong revenue and expansive international operations in generics and specialty drugs continue to underpin his wealth.

6. Cyrus Poonawalla – $23.1 billion (Age 84)

Sector: Vaccine Manufacturing (Serum Institute of India)

Cyrus Poonawalla turns vaccine manufacturing into wealth, as head of the world’s largest vaccine maker. COVID-era growth and global vaccine demand put him among India’s top industrialists.

7. Kumar Mangalam Birla – $20.9 billion (Age 58)

Sector: Conglomerate (Aditya Birla Group)

Birla leads a multinational conglomerate active in metals, cement, telecom, and financial services. The group’s breadth and stability keeps him firmly in the top 10.

8. Lakshmi Mittal – $19.2 billion (Age 75)

Sector: Steel (ArcelorMittal)

Although based in Europe, steel magnate Lakshmi Mittal is counted among India’s richest. His global leadership in steel production across continents sustains his high ranking.

9. Radhakishan Damani – $15.4 billion (Age ~70)

Sector: Retail (DMart, Avenue Supermarts)

The founder of DMart, Damani built his fortune through discount retail chains that remain highly profitable in India’s evolving retail landscape.

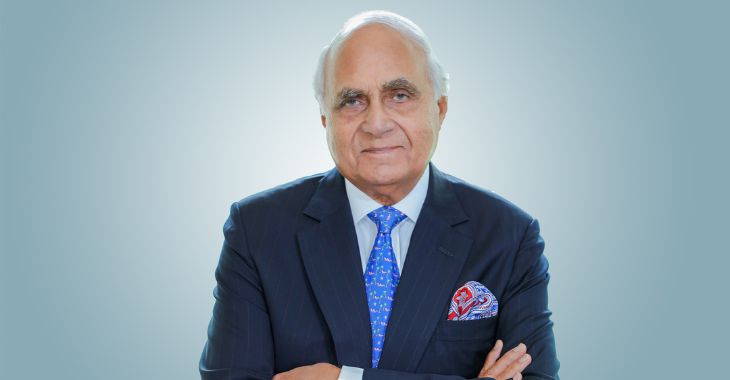

10. Kushal Pal Singh – $14.5 billion (Age ~93)

Sector: Real Estate (DLF)

K.P. Singh’s DLF helped shape Delhi’s skyline. Now chairman emeritus, his legacy real estate fortune returns him to the top 10 list this year—signaling resilience and legacy wealth.

Quick Snapshot of the 2025 Billionaire Landscape

- India now boasts ~205 billionaires as of mid‑2025—an increase from 200 a year prior—with a combined net worth nearing $941 billion.

- The top 10 richest Indians account for over one-third of that total (~$337 billion).

- Innovation sectors such as technology, finance, and manufacturing drive much of the wealth creation, but through diversification, industrial legacy, and infrastructure, figures like Ambani and Adani still dominate.

Context & Commentary on Some Titans

Mukesh Ambani: Stability Amid Volatility

Despite a ~20% drop in net worth from 2024 to 2025, Ambani stays at the top. His diversified interests—from energy to telecom to retail—shield him against single‑sector shocks. Reliance’s strong dividend payouts in FY25 provided significant private wealth gains beyond equity price appreciation.

Gautam Adani: On Trial and in Transition

Adani’s fortunes fell sharply post‑Hindenburg allegations and legal scrutiny. While his businesses rebound, the 2024 U.S. indictment poses a major challenge—not only legal but reputational. The allegations include bribery of government officials and masked borrowing—a serious case currently under legal process.

Rise of Next-Gen Ambanis

Separately, younger members of the Ambani family—Anant and Akash Ambani—now rank among India’s top wealth holders, commanding a combined net worth of Rs 3.59 lakh crore (~$43 billion), per 2025 indices. They are increasingly influential as Reliance transitions to next-gen leadership.

What Powers These Titans? Key Wealth Drivers

- Diversification across sectors — Business dynasties like Ambani and Birla span energy, finance, telecom, and consumer goods, cushioning their fortunes.

- Rapid sectoral growth — Infrastructure (Adani), pharmaceuticals (Shanghvi, Poonawalla), IT services (Nadar), and e‑retail (Damani) are sectors booming in India’s expanding economy.

- Dividend-driven income — In 2025, dividend payouts became a prime source of promoter wealth accumulation, especially visible among the Ambanis and other conglomerates.

- Global legacy businesses — Figures like Lakshmi Mittal carry legacy wealth built over decades, sustaining relevance globally.

Looking Ahead: Trends & Potential Disruptions

- Leadership transitions: With Mukesh Ambani planning to step back in the coming years, the roles of Akash, Anant, and Isha in steering Reliance’s future will define whether their wealth trajectory continues upward.

- Regulatory and legal risks: Ongoing scrutiny, especially for high‑profile names like Adani, may impact stock valuations and business credibility.

- Sectoral volatility: Rapid changes—particularly in green energy, generics, digital finance—could shuffle future rankings.

- Emerging seats: Expect rising wealth from new entrepreneurs in fintech, e‑commerce, renewable energy, and startups as India’s startup ecosystem matures.

Final Thoughts

The 2025 roster of India’s wealthiest corporate titans illustrates both enduring legacy and evolving enterprise. Whether it’s Ambani’s energy-to-retail empire, Adani’s infrastructure rebound amid legal turbulence, or the diversification of charismatic figures like Nadar, Jindal, and Shanghvi, these ten business leaders embody India’s economic dynamism. Their wealth fortunes reflect a mix of globalization, bold ventures, and strategic diversification.

As India enters its next growth phase—with transformative reforms, climate tech, green energy, and digital services—the emergence of new billionaire-era leaders is inevitable. But as of mid-2025, this top 10 continues to set the tone for corporate ambition in India.

Read More

Top 10 Famous Political Leaders in India 2025

Top 5 Quick & Healthy Tiffin Ideas for Office Lunch